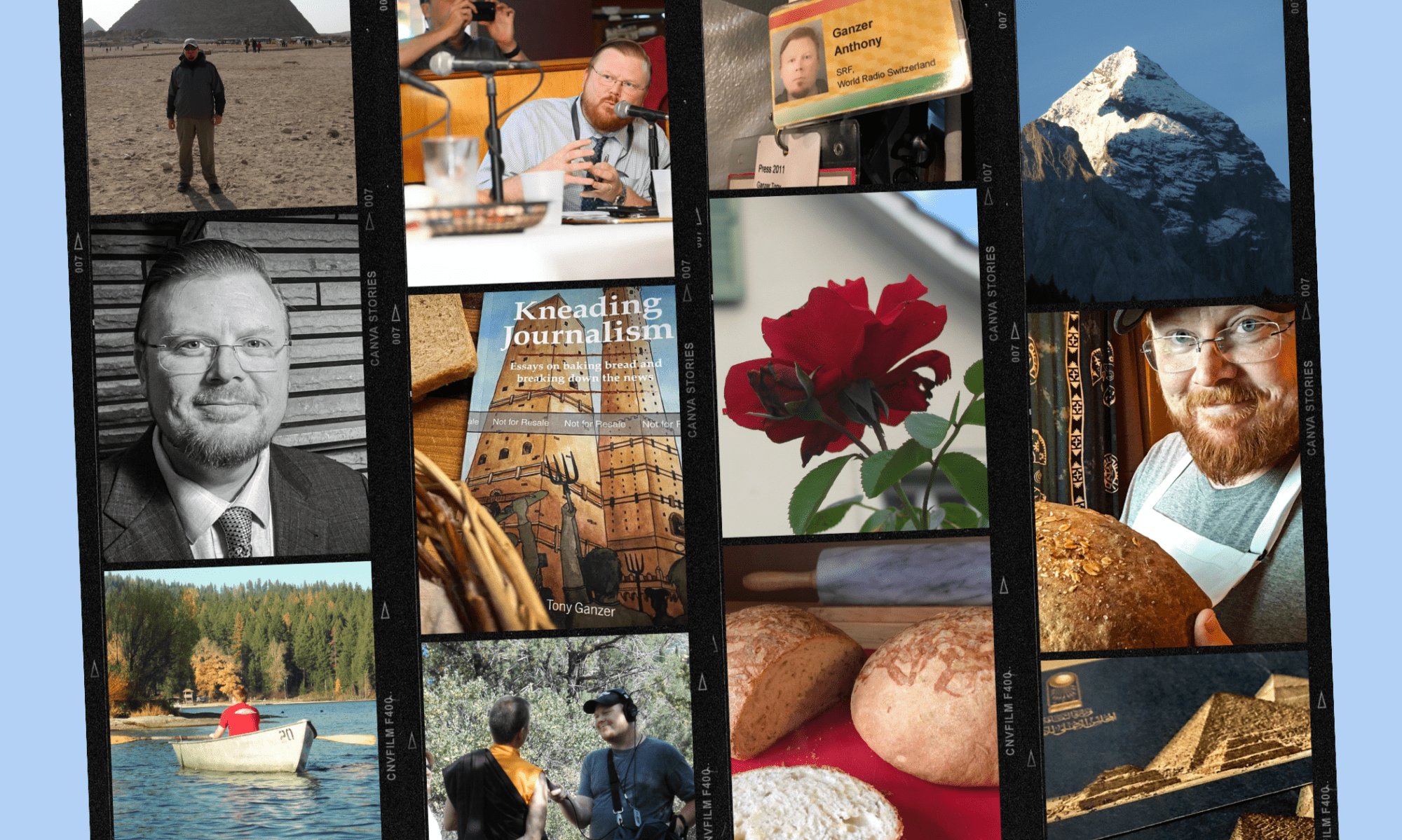

By most accounts Switzerland is an economic success. It has weathered the Euro Zone crisis handily, and over the last century and a half turned from an agrarian nation to one with a diverse and specialized economic portfolio. But why? Why is Switzerland a hub for pharmaceutical companies, banking and finance, chocolate, watches? This question will be discussed tonight on Business Insight, in a conversation with James Breiding, the CEO of Naissance Capital in Zurich, and author of Swiss Made: The Untold Story Behind Switzerland’s Success. WRS’s Tony Ganzer spoke with Breiding, beginning by asking why is there not more publicity for Switzerland’s success?

BREIDING: “The Swiss people are by nature very reticent, and one of the key sort of crucibles of the Protestant Reformation, so you have this sort of Calvinist, Zwingli tradition where you don’t show off, and you’re very sort of reluctant to talk. So there’s a deep-breaded history of discretion, some might even feel sort of secrecy, as it applies to banks, for example. On top of that, there’s just a whole bunch of businesses and industries here that don’t really deal with end consumers, it’s sort of business-to-business, so they really don’t have a need to talk and to explain to people what they’re doing, so that sort of contributes to this information deficiency. I was very intrigued to see, here’s a country [that] has incredible achievements: highest per capita GDP in the world for a country that doesn’t have a resource endowment, and more importantly it has the most egalitarian distribution of that earnings.”

GANZER: “As you point out, Switzerland of course was primarily an agrarian society before this amazing breakthrough somehow. Would you attribute the breakthrough to an advanced economy, financial center, to opportunism, or was it ingenuity in some way?”

BREIDING: “The fact that they had nothing is a great sort of pre-condition for wanting something and achieving things. It was the fact that they came from nothing, and had an ambition to be something that was the real sort of impetus. And I think also sort of being a mountain society, you know one has to be more cautious and people take provisions. There’s an expression in German, the old carpenter expression, where you sort of measure twice and cut once. So yeah, I think these were the preliminary characteristics that help I think spur the Swiss desire to succeed, and I think there are just other just different cultural aptitudes and attitudes towards wealth. Some people, I see for example in the UK, people if they make a lot of money they tend to buy a big house in the country and just retire. And I think the Swiss are the quite the opposite, they actually put a lot of value on wealth creation.”

GANZER: “Some of the traditional, what we think of as Swiss industries, are self-explainable I would say. Engineering through the Alps, for example, tunnel-building, rail technology—of course, this is a mountain country, you would expect that expertise…”

BREIDING: “Well so is Afghanistan…”

GANZER: “True, that’s true. But the point here is other Swiss industries, pharmaceuticals, banks, specialty machining, why did these also become ‘Swiss’ industries?”

BREIDING: “I think you’re right there are sort of geographical attributes of Switzerland that are very important. If you take for example milk. And Nestle is now the most profitable company in the world, it’s the largest consumer goods company. It originated as a producer of instant milk. But the reason why Nestle is in Switzerland was because the Swiss have a lot of cows. They don’t have much of anything else, they can’t grow wheat, but they have a lot of cows, and the cows graze as quite high altitudes, and milk is from its chemical composition one of the most fragile natural products you can have. So in warm temperatures it breaks down very rapidly and spoils. And this extra 1000, 1500, 1800 meters enabled the Swiss to be able to produce milk which had longer shelf-lives, which then led to the chocolate business. So yeah there were sort of inherited geographic advantages, you mentioned the tunnels and construction. They did sort of invent the tourism industry, which is a bit counter-intuitive. But yeah coming back to your point, what seems to be on the surface to be much more remote tended to have circumstances in-and-around that time that lent itself to the spark, the evolution of a particular industry. In the case of pharmaceuticals, pharmaceuticals started as actually dye stuffs, colors for the textile trade, and there was quite a large textile trade in Switzerland, eastern part of Switzerland.”

GANZER: “Graubuenden still struggling..”

BREIDING: “Glarus, St. Gallen, up until really the end of the 19th century, in order to create colors for textiles you had to get them through natural sources and it was the British Empire that controlled these through their colonies. And in order to circumvent and respond to the fact that there were embargoes and protectionism, the sort of German scientists became intrigued about the possibility of creating synthetic versions of these colors. And since there was quite a large textile base in the Alsace region, which is just near Basel, this was a fantastic place to do it, and in many ways they were mimicking developments that were occurring with the German pharmaceutical industry.”

GANZER: “Many countries are trying to figure out how exactly to cope, or maneuver within ‘globalization’ and two of the black marks, I guess, on Swiss history have been, I would say, coping with globalization were SwissAir failure in the early Naughts, of course was a result of an expansive strategy trying to snap up too many players at once. And then UBS, the bailout in 08, was a consequence of being a global financial player still within a tiny Alpine economy. Does this not bode well for Switzerland’s future in a more interconnected world, or do you think they can adapt?”

BREIDING: “Those are two pretty visible and revealing examples of things that go wrong, the things that have gone wrong. I mean, there’s a lot of examples of Swiss companies that are quite the opposite of incredible success stories. And just to get the facts right, the Swiss have the highest per capita density of Fortune 500 world-leading companies in the world. So their garden they have taller oak trees, fatter oak trees, than any economic garden in the world. And this is by a factor of 4 to 5, so that to me was sort of interesting. Why is it that the small resource-less country with a bunch of mountains, and ski slopes, a little bit of chocolate, you know why is it they have two of the leading pharmaceutical companies in the world? Why do they have..Zurich insurance is the one of the biggest direct insurance companies in the world. So in that garden there have been a few mishaps. In every place in the world you’re going to have mishaps. And someone like Joseph Schumpeter suggested that’s probably quite a good thing to have creative destruction, to have failed companies, because it spurs a lot of things on. ”

GANZER: “The problem though is, SwissAir was a black eye, and it was a trauma to the Swiss people. UBS could have been a fatal blow. And is that a good thing that so many of these big companies are here that it could bring down the state, so to say?”

BREIDING: “It is, that’s a fair point. I think in the case of SwissAir, it was one of the rare times where the Swiss sort of lost their rationality, and I think there was a lot of national pride tied up with the industry that precluded them from acting in a very rational manner. And I think there was a very fundamental belief that in terms of self-sufficiency which is a very important value in the Swiss, that they really needed to have a national airline, and I think that’s why they fought for that, and really struggled to get that right. In the case of UBS, I think it’s a very different story. And I think you’re right that there are increasing concerns, not just in Switzerland, but in places like London, New York, etc, about this whole too big to fail. I mean, this debate didn’t exist five years ago. I think the financial crisis showed it’s a very real problem, and it needs to be addressed. But yes as a small country, the Swiss are at risk of losing some of these companies, or to have a situation where companies like Nestle are of a magnitude in size that dwarf in comparison to the [country.] There was an old story that maybe talks to this point, was Victor Blanco was a famous Swiss diplomat who negotiated the potential entry of Switzerland into the extended European community and he said once to me, that if you’re in Brazil there are two people who can see the Brazilian Prime Minister within 24 hours. One is the US ambassador to Brazil, and the other one is the CEO of Nestle. So probably on that list the Swiss ambassador to Brazil is pretty far down that list, so it gives you a sense of really where the power resides. And it is something that is unique to Switzerland, and poses certain advantages and certain limitations and risks.”

GANZER: “One of your major conclusions, I guess, is how remarkable it is that Switzerland has been able to keep inequality relatively low, in comparison to other countries, while it has grown as an economy. But it also has nearly a quarter of its population as foreign, which makes me think of the famous Max Frisch quote, ‘we asked for workers, we got people instead’ during the guest worker program of the 50s, 60s, 70s coming into Europe. Do you think that mindset still exists in Switzerland, that they just want workers and not people, and is that a viable strategy going forward to keep the quality of life as high as its been going forward?”

BREIDING: “I think there’s a little bit of a schizophrenic attitude about immigration, not just in Switzerland, but it’s not easy being an immigrant anywhere in the world these days. But if you just sort of take away the emotions and let’s say the hype if you like of current debates and discussions around immigration, I think Switzerland’s success, and we say that in the book, is to a large extent attributed to the fact that they’ve actually been quite open to foreigners. It hasn’t been easy. The entry point is probably easier in places like the UK, the US, but every important Swiss company that we studied, had during its formative period, a foreigner played a pivotal role. Henry Nestle was a German […] and so on and so forth, and what we found in the study is immigration is critical. And there’s two forms of immigration, and that’s what makes Switzerland so unique. As you say about 30% of the population in Switzerland are either first or second generation foreigners, but I think what’s also important is about 15% of Swiss live abroad. I had a fellowship at Harvard in connection with this book, and I remember speaking to Professor Gardner who’s a very famous professor of education there, and he wrote a book called ‘Creating Minds’ where he studied twenty exceptional people. And then afterwards he tried to find out the pattern of success. And the pattern was that these people tended to come from an environment that was very remote to where they went, so there was this element of immigration because it forces people to think and behave in a very different way, and I think it confirms a certain disposition toward risk, and it forces people to undertake more risk. So I think that’s something that will not change, and I think a bit the issue Switzerland’s confronting is that the nature of the immigration is different. It used to be that the people who were coming because of religion or beliefs, and now it’s much more about standard of living, and that’s a different type of immigration, and that probably rubs against the political sentiment in a very different way.”

GANZER: “Switzerland of course was a famous mercenary country, providing military all over Europe, and now the economy is primarily staffed by foreigners which one could say are kind of like economic mercenaries. Machiavelli in ‘The Prince’ said any duchy which relies on mercenaries is doomed to fail. Do you think Switzerland is doomed to fail, the fact that a quarter of the population is foreign and, as you say, is pretty much here for the check…for the money?”

BREIDING: “I think there is some truth in what you’re saying. I think that about half of the companies now are run by foreigners. And there was kind of a popular movement in the last generation along the lines that said we have to find the most talented person we can find, and irrespective of whether they’re Swiss, and the logical extension of that was since Switzerland is a small country he’s probably going to be coming from somewhere else. So it became very fashionable, very popular to find non-Swiss people. It difficult to argue against that in the individual case. The problem you have is when that sort of becomes in the aggregate quite a large number, and now you have 50-55% of these industrial companies that are run by foreigners. I think people probably mistakenly underestimated that a person who is naturally Swiss by origin and grew up in Basel or grew up in Baden has a lot at stake in terms of reputation, and shame is a very effective determinant of behavior in any society, and the fact is that these people can muck it up and just go back to Denver, or Singapore, or Hanoi, or whatever, and have their money and go back to their support groups, etc. And I think none of the studies show that money is a motivating factor beyond a certain point. I think maybe part of the benefit of this study has been as well to show to the Swiss themselves, without having intending it, that those companies that still have and continue to sort of adhere to this Swiss way of doing things in terms of compensation, which was a huge issue recently in a referendum but not just that, in a whole variety of aspects they have actually been the companies that have done the best. And we’ve studied that on a peer-to-peer basis together with the Swiss National Bank, we look at companies–Schindlers compared to Otis, Roche compared to Glaxos, and Pfizers and Mercks–and a) the Swiss did better with their peers, and b) the ones who were actually truly Swiss, and that have continued to adhere to these values, have actually done it extremely well.”