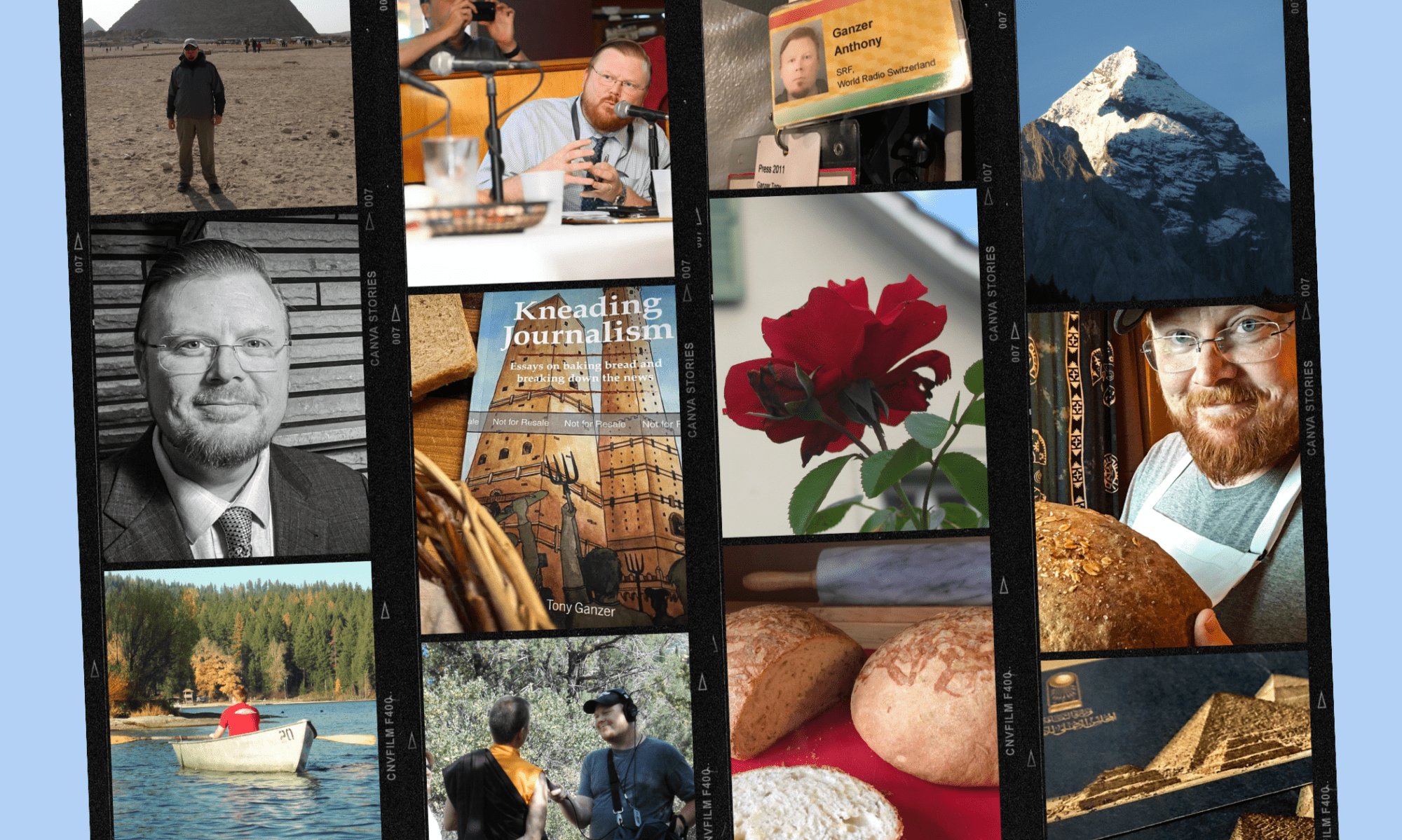

The value of the U-S dollar has stumbled in recent years, making some people lose faith in the U-S economy, instead turning to more tangible forms of money. KJZZ’s Tony Ganzer reports on a trend bringing financiers, survivalists, and average Joes together in a modern Gold Rush.

Gold and other precious metals have long been the “insurance” currency of survivalists and other people who think the paper U-S dollar won’t hold up in the future. Some gold proponents say the dollar is failing, and gold will be the only currency that will always be money—regardless of what happens in world markets.

(NATS: gold “harmonics” …Smith—“now that’s the sound of real money.”)

TG: Richard Smith owns the Coin Gallery of Phoenix; Arizona’s largest coin shop, selling everything from silver pieces, to gold coins and bouillon, to pieces of platinum. He demonstrates how you know “real gold” by the harmonic tone two gold coins produce when tapped together.

(NATS: harmonic—SMITH: oh..I can do better…harmonic)

TG: Dollar-doubters are no longer the only people converting their greenbacks to golden coins and bars. Smith says his business has increased sharply in the last couple of years. He says college professors, financiers, and people from all walks of life frequent his shop,

SMITH: “A lot of people got shaken out of stocks in 2001, when it proved not to be going to the moon. The pressure’s on the dollar. Deficit spending has really shaken people’s faith in the dollar, both regular people on the street, and central bankers, and they’re going to tangible assets…Gold is my preference as a good old fashioned money substitute.”

TG: But why would someone need a money substitute? Green backs are money like anything else, aren’t they? The reason lies, Smith says, in world trade. The dollar, like most things, is influenced by world business, and how much faith people put in the U-S government, the dollar’s biggest supporter. If people start to lose trust in the U-S economy, the value of the dollar falls.

SMITH: “Blame it on what you want..but it’s a loss of faith in the dollar. You can say gold has gone up two and a half times, or you can say the dollar has depreciated two and a half times against gold.”

TG: According to some experts, the fall of the dollar is not necessarily always a bad thing. Lee McPheters is with Arizona State University’s W.P. Carey School of Business.

He says a lower-value dollar, may actually help the U-S and local economies, and might not be a sign of an impending market/currency crash.

MCPHETERS: “Even though we don’t like the concept of the dollar getting weaker, the fact is a weaker dollar will help our aerospace industry which is one of our big exporters. It will probably help us in electronics and copper as well.”

TG: A cheaper dollar, means other countries can buy more U-S products for the same price..in turn helping the overall economy.

(NATS: Fade up nats of shop)

TG: But Richard Smith in the Coin Gallery insists Gold is a viable option for long-term saving. He says many of his customers know the value of gold may flux a little with world markets, but it’s a proven substance that retains much of its value over time.

Sentiments like that have spurred a new kind of gold rush. Gold bottomed out in 2001 at a low of $250 an ounce, and is now trading for a little more than $630 per ounce.

For KJZZ, I’m Tony Ganzer.