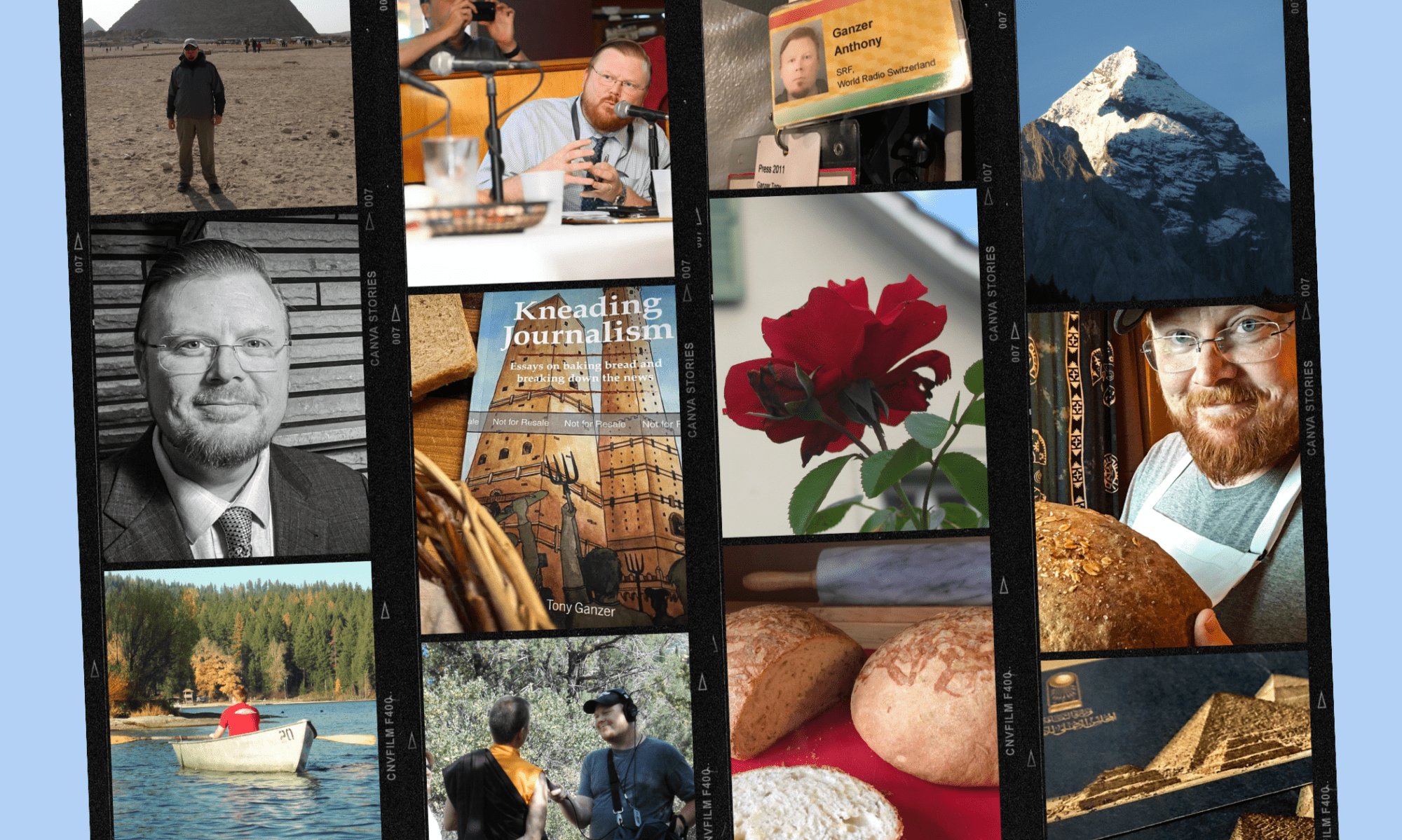

As the United States will soon choose its next president, we at WRS have been looking at relations between the US and Switzerland. Yesterday, we heard about trade and diplomacy between the nations. Today, we will look at the issue most pressing for Switzerland: banking and taxation. Will US elections much effect the way things are going for Switzerland? Is the relationship a good one, despite aggressive US investigations into Swiss banks? WRS’s Tony Ganzer reports.

Swiss banks have taken on an urban legend kind of persona in the last decades, encouraged by legitimate claims and Hollywood minds alike.

MARKWALDER: “Switzerland does not only have the image of being a tax haven, but of course the Swiss bank accounts were also often used in the Hollywood movies to be the accounts of the gangsters or of criminals.”

Christa Markwalder is a Swiss lawmaker from Bern, and sits on the Foreign Affairs Committee.

MARKWALDER: “We really have to shift this image to a positive one, saying that we offer good services in the financial sector. No one has an interest that persons are able to evade taxes. I also think there is a very different approach of tax evasion in the U.S. and in Switzerland.”

Markwalder there is referring to the fact tax delinquency is not a criminal offense in Switzerland—you won’t go to jail for not paying, you will just have to pay, sometime.

In the US, tax collectors are not so accommodating. But she stresses the Swiss have the rule of law, their own system.

But it is a difference of thinking about taxation that perhaps fuels an on-going conflict between Switzerland and the US on alleged American tax evaders hiding assets in Swiss bank accounts.

METTLER: “It is clear that on the other side there is a 500 pound gorilla and you are a small country, it is clear that the small country does not dictate the rules.”

Alfred Mettler is a Finance Professor at Georgia State University.

He is also Swiss.

He says the Swiss government’s push toward a Weißgeld Strategie, or clean money strategy, doesn’t really matter from the American tax collection point of view.

METTLER: “I don’t think so, but I think the Weißgeld strategy is strategically smart for Switzerland. It allows Switzerland to put the past behind, and position its financial center in a competitive way in this new world that has emerged. Bank secrecy is a thing of the past, but it seems to me that privacy is still, or even more and more, valuable.”

The United States is still an economic, diplomatic and military powerhouse, against which a country like Switzerland can’t do much.

Even combining forces on tax issues, or data exchange issues, with the EU could not ward off investigations and pressure from the US.

But Mettler says the Swiss dealing with the US to tax foreign client assets in Swiss banks for example, could help.

METTLER: “We already see it playing the other way around. The agreement that Switzerland will hopefully eventually reach with the U.S. may also increase the pressure from the European Union to get something along similar lines. But I would not see it the other way around. Switzerland having the same rules like the European Union, that that would help with the U.S., I don’t think so.”

US investigators have focused in on Swiss banks allegedly aiding clients to evade taxes, spurred by a previous deal with big bank UBS which led to thousands of client names transmitted from Switzerland.

It was devastating blow to Swiss banking secrecy, and may have set a precedent for US-Swiss relations of the present and future.

Peter Kunz is a law professor at the University of Bern, and he said this to WRS in August.

KUNZ: “In my view Switzerland really made some big mistakes four years ago with the United States. They didn’t try to really oppose claims by the USA which were unreasonable, and of course the USA and the IRS, Department of Justice, and so on, now know they just have to put some pressure on Switzerland, and Switzerland gives them more or less what they want.”

NEDLIN: “Clearly there have been some additional tensions over the past four years, but I don’t want to focus too much on those tensions because as valid as they are, and important as they are for Switzerland and for the US of A, I think the ties that bind our nations are very strong.”

Mark Nedlin is chairman of Republicans Abroad in Zurich. He also works for a large American bank.

While taxation, data exchange, banking regulations are all vital issues for Switzerland, Nedlin thinks they only make up a small share of the Swiss-U.S. connection.

NEDLIN: “We are part of the same tradition, we are part of the Judeo-Christian ethic. We are both advanced, very wealthy democracies. We strive toward the same big picture goals. Every relationship has tensions, but what differentiates strong relationships from weak relationships is that in a strong relationship those disagreements, those differences are resolved in a mutually acceptable and civilized way. And this is, I’m fully confident, this is what will continue to happen.”

Nedlin thinks the bilateral relationship will change for the better under a Romney administration.

Swiss lawmaker Christa Markwalder thinks the Swiss have more an affinity to Mr. Obama, but the election may not matter much for Swiss-US relations.

MARKWALDER: “Probably it doesn’t really matter if the Republicans or the Democrats are in power, but there are issues that are long-term issues, that we have to find solutions.”